In today’s digital commerce thrivingness, store credit has been a financial weapon changing the game between consumer and business.

But what exactly is store credit, and how does it function?

Let’s explore store credit, what is its operational processes, and the benefits it offers to stakeholders in the market.

What is Store Credit

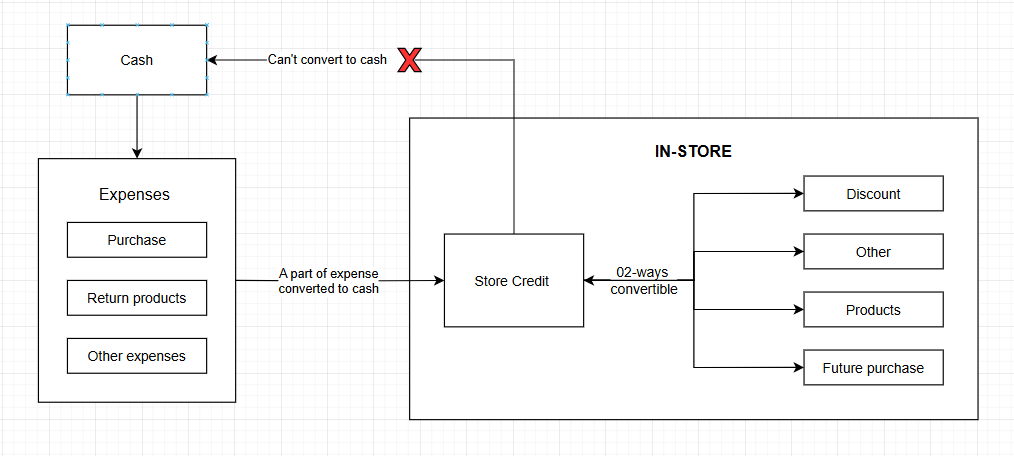

Store credit (also known as in-store credit) is currency given by a store instead of cash for returned items that are not refundable. It’s used for future purchases only in that store and usually expires. It aims to keep customers coming back, especially those who return items or have problems with purchases.

Store credit strategy shows its highest effectiveness when associating with loyalty programs & referral programs. By joining a loyalty program, customers can earn credit by reaching expense milestones, and by joining a referral program, they can earn by inviting others to buy products.

It is used in almost any case in which a store is required to pay an amount of cash for their customers. However, it is usable to pay for partners and associates. Store credit is also often used to reward affiliates.

See more: Top 07 Shopify Store Credit Apps

An example of store credit

Let’s say you buy a shirt from a clothing store, but when you get home, you realize it doesn’t fit you well. When you return it to the store, they might not give you cash back. Instead, they could offer you a store credit that you can use to buy something else from their store. You’d only need to pay extra if the new item costs more than your store credit.

How does store credit work?

Store credit can be understood as an exclusive currency – which can be usable in one store only. Here’s how it usually works:

- Credit issuance: Customers might get store credit instead of money back if they return something or as a reward for being brand-engaged.

- Values: Usually, it’s worth the same as the item returned or the value of a promotion.

- Expiration date: Store credit usually has a date when it can’t be used anymore. This date is on the credit or in the store’s policy.

- Restriction: Sometimes, a store credit can only be used for certain things or during specific times.

- Usage: Store credit can be used in the store or sometimes online, depending on the store’s rules.

- Balance: If customers spend all their store credit at once, they can use the rest later.

- Non-transferable: Usually, only the person who got the store credit can use it. It can’t be given to someone else.

- Refunds: Sometimes, if customers ask, the store might give them their money back instead of store credit, but it depends on their rules.

Every store has different credit policies which may vary depending on their business strategy. For example, in some cases, there is no expiration for store credit.

Remember to read the rules to know how to use store credit and if there are any limits.

Types of store credit

Stores or retailers usually give out store credit in a few different ways. Here are some common methods:

- Returns and exchanges: When return an item to a store, instead of getting cash back, they might give you store credit to use later.

- Store credit cards: Some stores have their branded credit cards. You can use them to buy products and sometimes get rewards or discounts.

- Gift cards: These are like prepaid cards with a specific monetary value that can be used to make purchases. You can give them as gifts or use them for yourself.

- Loyalty rewards: Lots of stores have programs where you earn points or rewards when you shop there. Sometimes these rewards come as store credit and you can use it for future purchases.

- Promotional offers: Stores sometimes give out store credit as part of special promotions or loyalty programs. For example, they might give you store credit if you reach milestones of expenses during an event.

What store credit can exchange for?

Store credit can typically be exchanged for goods and services offered by the business that issues the credit. This includes:

- Products: You can buy items like clothes, electronics, groceries, and more, depending on what the store sells.

- Services: Sometimes, you can use the store credit to pay for services like repairs alterations, shipping, or installations.

- Gift Cards: Some stores let you use store credit to buy gift cards, either for yourself or to give to someone else.

- Online Purchases: If the store has a website or app for online shopping, you can (in most cases) use store credit to make purchases there too.

- Rewards for partner: Store credits can be paid to store partner (e.g. brand’s affiliate or ambassadors), instead of cash or products.

Additionally, it is important to make sure to understand the rules for using your store credit. Usually, you can’t turn it into cash or transfer it to another unless the store’s policy allows it.

How to manage store credit?

For online stores, the credit balance is recorded in the customer’s online account. This way, when customers shop on the website, their credit balance is linked to their account. They can check store credit balances, earn credit when buying or via promotions, and exchange credits for products.

And they can do all of the above online.

For traditional brick-and-mortar stores, credit is usually kept using customer cards. Unlike regular credit cards that are accepted at many places, store credit cards can only be used at the specific store that issued them.

These cards have special numbers that connect to the customer’s account. When customers buy items in the store, the system combines the card info with the date of purchase. This makes sure their credit balance gets updated, and they can use it later when they buy more stuff.

Typically, these store credit cards may come with additional rewards for loyal customers.

Store credits: Advantages and Drawbacks

Store credit is a strategy that retailers love. Of course, its main function is to be a supportive tool for business owners, rather than buyers.

Advantages

- Customer Loyalty: Offering store credit can help build customer loyalty and encourage repeat business, as customers may feel more connected to the shop and more likely to return for future purchases.

- Reduces cash outflow: Instead of providing cash refunds, businesses retain the funds within their system.

- Competitive Edge: Providing store credit can differentiate a shop from competitors and attract customers who value the convenience and flexibility of purchasing on credit.

- Inventory Management: Store credit can help shop owners manage inventory by allowing customers to make purchases even when they don’t have cash on hand, reducing the need for markdowns or clearance sales to move stagnant inventory.

- Marketing Element: Store credit programs provide opportunities for marketing and promotions, such as offering special incentives or discounts to customers who use store credit for their purchases.

Drawbacks

- Cash Flow Constraints: Store credit ties up cash flow, as shop owners must wait for customers to repay their credit balances before the revenue can be realized.

- Fraud Risk: The store credit system of a store might be the target of a scammer. In many cases, customers simply provide false information or use stolen identities to obtain credit.

- Can be targets of hacker: Store credit databases, just like scams in affiliate marketing or any other business model, might be targeted by hackers. They can simply change the credit balance and get free products from your store.

Remember that store credit policies can vary from one retailer to another, so it’s essential to check the terms and conditions associated with any store credit you receive.

Best store credit apps for eCommerce

When talking about store credit apps, each e-commerce platform offers its app store with

various options. Here’s a breakdown of some popular platforms and most-voted store credit apps to consider:

For Shopify

- CreditsYard: This app allows you to create a digital wallet for store credit, which can be used for returns, exchanges, and cashback.

- Rewardify: Connects with Shopify POS and Online, offering a central location to manage store credit accounts for your clients.

- BixGrow: BixGrow allows you to recruit and create your store’s affiliate network. Store credit can be used ONLY to pay for affiliates as rewards for referring others.

For BigCommerce

- Store Credit: A built-in feature within BigCommerce that allows you to create and manage store credit for customers.

- Loyalty Lion: Offers a loyalty program with features like store credit rewards, along with other functionalities.

For WooCommerce

- WooCommerce Points and Rewards: A popular option that lets you create a points system where customers earn points that can be redeemed for store credit.

- Gift Cards by WooCommerce: This enables you to sell gift cards that can be redeemed for store credit.

For Square Online

- Square Loyalty: A built-in loyalty program that allows you to offer reward points redeemable for store credit

For Wix Ecommerce

- Wix Stores – Loyalty Program: A built-in feature where you can create a loyalty program with reward points redeemable for store credit.