Affiliate marketing is a thriving industry, and there are a bunch of guys (e.g. Neil Patel) who earn millions every year with it. Wanna be an affiliate? There are some regulations and rules of affiliate marketing you need to learn, and keep in compliance with.

Well, besides marketing skills, you need to actually ensure your compliance with the laws regulating affiliate marketing activities.

What is affiliate marketing?

Affiliate marketing is when people or businesses promote products from other companies and get paid for driving sales or traffic to those companies’ websites. It’s a win-win game. Companies gain more sales, and affiliates earn a share of those.

Here’s how it works:

- Step 1: Affiliate signs up

- Step 2: Affiliates get affiliate links

- Step 3: Affiliate promote products (with the links)

- Step 4: Visitors buy via links

- Step 5: Affiliate earns.

Is affiliate marketing legit?

Yes, affiliate marketing is 100% legit. It is a legal business model and is accepted by all countries all over the world.

It is widely used by big brands, such as Lego, Nike or Walmart. As an affiliate, you have the right to legitimately promote the brands above.

While affiliate marketing is a legitimate business model, there are regulations that you need to follow before diving into it.

Who regulates affiliate marketing?

Affiliate marketing is regulated by various agreements and laws, which depend on the target market and the location of the affiliate.

As an affiliate marketer, your activities are regulated by:

- Authority of the market you are promoting in: Typically, local trade control organizations and business associations. In the United States, this includes the Federal Trade Commission (FTC) and the Better Business Bureau (BBB). For instance, if your customers are primarily EU-based, you need to keep compliance with GDPR.

- The local authority where you are based: You have to pay taxes and fulfill other social duties based on the regulations of the region you are located in. For example, if you are based in the Philippines, you must pay taxes and fulfill obligations related to social insurance or Medicare.

- Affiliate contract: Given that affiliate marketing often crosses borders, the relationship between affiliates and merchants is primarily governed by their contracts to simplify international law involvement. For example, dispute resolution typically involves negotiating in good faith or seeking arbitration, rather than going to local court.

Who needs to keep compliance with affiliate marketing laws?

Individuals who promote a brand in exchange for sponsorship or earnings must keep compliance with affiliate marketing laws. These individuals include:

- Affiliates – Typically earn commissions.

- Influencers – Usually promote products through sponsorships.

- Brand Ambassadors – Often earn through a mix of commissions and sponsorships and are identified by their long-term relationship with the brand. This type is different from affiliate, who just earn commission.

An exception is those who act as referrals. They are typically part of the brand’s referral program or are loyal customers. These individuals can get commission relying on word-of-mouth referrals, which depend heavily on their personal networks.

In referral programs, participants typically receive a fixed amount of money for each referral, though this varies based on the brand’s policy. Referral sales commissions often have a cap, unlike the unlimited earnings potential of affiliate programs. For instance, Samsung’s referral program offers $100 per referral but only up to five (05) referrals, after which no further commissions are earned. Conversely, Samsung’s affiliate program offers unlimited earnings, albeit with lower commission rates.

While the brand could get into some trouble if things aren’t done right, ultimately, affiliates need to ensure everything’s legal and transparent with our community. And, just because you might not be aware of all the legal stuff doesn’t mean you are out of legal risks!

Whether you are sharing affiliate links, promo codes, or getting goodies in exchange for promoting products, it’s crucial to let our audience know about our relationship with the brand.

What is the legal framework for doing affiliate marketing?

Well, there are quite a few regulations that modify your affiliate marketing activities. The requirements may change based on locals, but here are some of the same duties of affiliates in every market.

There are a few things you need to keep in mind in order to make sure your affiliate marketing meets certain legal requirements.

- Disclosure duty: Most of the laws around affiliate and influencer marketing are aimed at ensuring that your community is AWARE that you have a connection with the brand you are promoting or endorsing and that they understand that you are being compensated in some way for promoting them.

- Advertising laws: You have to avoid bad practices of advertising (e.g. clickbait ads banners)

- Consumer data protection: As an affiliate, you collect data from audiences (e.g IP address). Therefore, you have the duty to treat those data as written bylaws.

- Affiliate contracts: There are regulations that focus on protecting brands, which are typically encoded in affiliate contracts. For example, terms and conditions related to commercial keywords bidding.

- Tax duty: You have to pay affiliate taxes when your total earnings reach a certain threshold. This benchmark changes depending on the country you are located in.

You can a more comprehensive list of requirements in this article: 05 Main Affiliate Requirements.

What happens if an affiliate is non-compliant with regulations?

If you violate those terms above, there are chances that you have violated the contract you signed with the merchant. In bad cases, your sales are considered un-eligible, and commissions are not accounted to you, and you did not earn anything with bad marketing practice.

If you are a member of an affiliate network, you might get banned forever from it. Which means you lost all connections with many advertisers.

A more serious violation might lead to legal action.

How to legally do affiliate marketing?

This is a guide on how to do affiliate marketing that avoids the risk of not being complaint with the law.

1. Honesty of affiliate advertising

Provide your audience with honest experience. Only promote products or services you have personally used and genuinely like.

Plus, your options should be trustworthy at the very least. Ensure that your reviews and endorsements reflect your true and current opinion.

2. Make affiliate disclosures

Disclose any relationship with the brand, including payments, free products, or any form of compensation.

Terms used as disclosures

- Use clear and specific disclosure terms like “Paid ad,” “#Ad,” “Sponsored,” or “#Sponsored.” Avoid ambiguous terms like “Thanks” or “Collab.”

Places to place disclosures

- Disclose any relationship with the brand, including payments, free products, or any form of compensation

Keep disclosures consistent

- Include disclosures in every promotional post, blog, video, or any other content where you promote the brand.

- For, live streams and stories, you should mention the affiliate relationship multiple times during live streams or stories to ensure viewers are aware.

3. Local advertising regulation

As an affiliate, you should follow the advertising law of the marketing in which you promote the brand’s products.

Each region has its distinct advertising laws.

Adhere to the specific disclosure requirements in the marketing in which you are promoting.

Check the local advertising laws. For example, the Federal Trade Commission (FTC) in the US and the Competition Bureau in Canada.

4. Protect customer data

Affiliates and merchants should respect consumers’ privacy rights and comply with data protection laws such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States.

5. Avoid non-compliant practice

Both affiliates and merchants must be honest and transparent in their marketing efforts. They should not make false claims or engage in deceptive practices that could mislead consumers.

Here are some non-complaint & un-ethical actions to avoid:

- Cookie stuffing: Placing tracking cookies without permission.

- Misleading banner ads: Displaying deceptive ads or clickbait.

- Forced clicks: Manipulating users into clicking ads.

- Adware and spyware: Displaying unwanted ads or collecting sensitive information.

- Non-disclosure of affiliate relationships: Failing to disclose the affiliate-advertiser connection.

- Typosquatting: Using domain names similar to popular sites to mislead users.

6. Intellectual property and copyright

It may seem straightforward, but achieving perfect compliance can be challenging.

Affiliates must adhere to intellectual property rights, including trademarks and copyrights. Unauthorized use of protected content, such as logos or images, can result in legal consequences.

To ensure full compliance, affiliates should utilize pre-made marketing materials provided by merchants and adhere to the merchant’s guidelines.”

7. Tax responsibility of affiliates

In terms of tax liability, affiliate marketing presents a unique situation as affiliates refer customers rather than directly selling products. Tax regulations vary by country. For U.S.-based affiliates:

- Most states exempt affiliates from sales tax since they earn income from referrals rather than sales.

- If your affiliate business is incorporated, federal income tax applies.

- Operating as a limited liability company requires filing an informational return and paying individual income tax.

- City taxes may apply depending on local regulations.

- Affiliates are also responsible for self-employment taxes, covering Social Security and Medicare.

- Regulations differ by location, so understanding local laws is crucial.

Even without a business license requirement for affiliate marketing, reporting income and fulfilling tax obligations is essential. Consulting with a tax professional can provide clarity on your responsibilities

Conclusion

That’s everything you need to know about the laws, regulations,s, and compliance requirements in affiliate marketing. This includes understanding the regulatory bodies that oversee your activities, identifying deceptive practices to avoid,, and ensuring adherence to affiliate marketing laws.

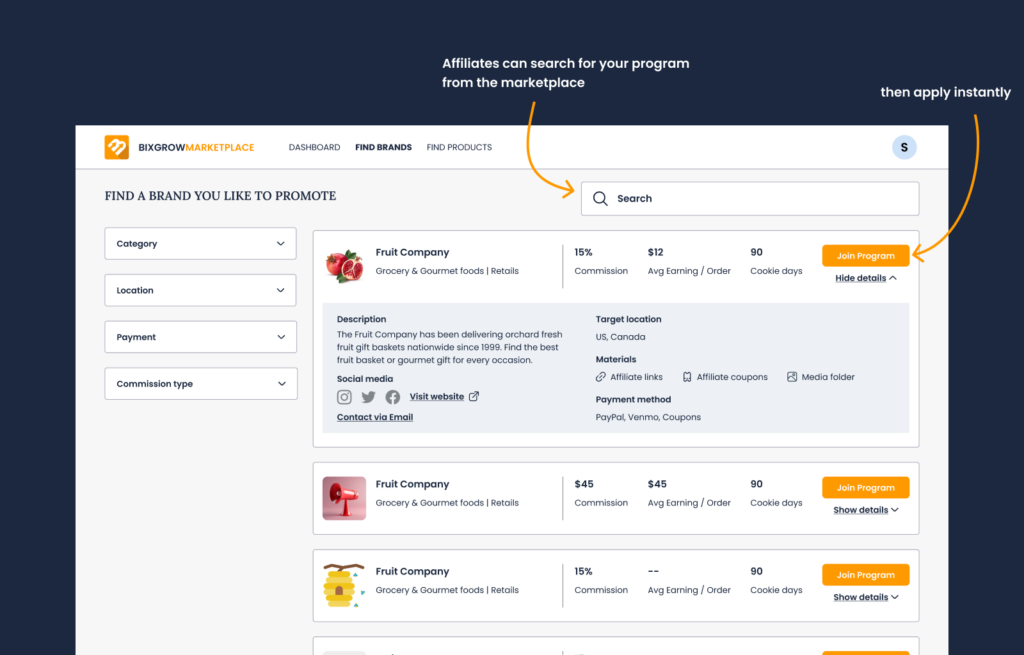

To find worthwhile affiliate programs to explore, visit our marketplace, which hosts over 6,000 merchants.