In 2023, the affiliate marketing industry was valued at a staggering $10 billion, with consistent growth expected in the coming years. For affiliates, timely payments build trust and motivate the continued promotion of your brand. For merchants, offering flexible and efficient payment methods enhances affiliate satisfaction and program success.

In this guide, let’s explore six common affiliate payment methods & how to pay affiliates effectively.

What is an affiliate payment?

An affiliate payment refers to the commission or reward paid by a merchant to an affiliate for driving a desired action, such as a sale, lead, or click. These payments are the core of affiliate marketing, incentivizing affiliates to promote a brand’s products or services to their audience.

Affiliate payments are typically calculated based on predefined terms outlined in the affiliate agreement. For example, an affiliate may earn a percentage of the sale amount (e.g., 10% commission) or a fixed payment for each lead generated. The payment structure ensures that affiliates are compensated for their efforts while keeping costs performance-based for the merchant.

Payments are usually processed on a set schedule, such as monthly, bi-weekly, or after reaching a payment threshold. For example, Amazon Associates, one of the largest affiliate programs globally, pays affiliates monthly. Commissions vary by category, such as 3% for electronics and up to 10% for luxury beauty products.

Common compensation models include:

- Pay-per-sale: The affiliate earns a percentage of the sale price.

- Pay-per-lead: The affiliate earns a fixed amount for generating leads, such as email signups or app downloads.

- Pay-per-click (PPC): The affiliate earns based on the number of clicks their referral link generates.

Why are choosing affiliate payments method important?

There are many affiliate payment platforms and methods.

- Building trust: Timely and accurate payments show affiliates their work is valued, encouraging them to keep promoting your brand. Not all payment method ensure timely payment, especially when you choose an outdated platform or un-trustworthy one.

- Keep affiliate comeback: A smooth payment process makes affiliates more likely to stay loyal to your program, reducing churn.

- Attracting affiliates: A certain payment method may restrict or encourage affiliates to partner with your brand. For instance, you can recruit international high-skilled affiliates using PayPal, while still limit the choices to bank transfer method for affiliates came from the USA, allowing simpler control.

Affiliate payments are the foundation of a successful program, ensuring affiliates feel rewarded and motivated to continue driving results. Luckily, most affiliate management software allow you to set multiple payment methods at once, hence affiliates can easily choose one that fit them.

Best 6 common affiliate payment methods

Choosing the right payment method for your affiliate program is crucial to ensuring smooth transactions and affiliate satisfaction. Below are six commonly used affiliate payment methods and their pros, cons, and ideal use cases.

Bank transfer

A bank transfer is a direct payment made from the merchant’s account to the affiliate’s bank account. This affiliate payment method is one of the best for established affiliate programs with affiliates primarily located in the same country as the merchant.

For example, platforms like ShareASale offer direct bank deposits to affiliates in supported countries.

Pros

- Simple and reliable for domestic affiliates.

- No intermediary platforms or accounts are needed.

- Suitable for high-value payments due to no percentage-based fees.

Cons

- International transfers can incur high fees and exchange rate charges.

- Slower processing time, especially for cross-border payments.

- Requires affiliates to share sensitive banking details.

PayPal

PayPal is one of the most popular payment methods, offering a fast and secure way to transfer funds. It is ideal for international affiliates or programs with smaller payments due to its accessibility and convenience.

Amazon Associates allows PayPal as one of its payout methods.

Pros

- Widely recognized and used globally.

- Quick transfer times, often instant.

- Affiliates only need an email address to receive payments.

Cons

- High transaction fees (up to 2.9% + $0.30 per transaction).

- Some countries have limited PayPal functionality.

- Affiliates may face withdrawal fees or currency conversion charges.

Checks

Payments are made via paper checks mailed to the affiliate’s address. Checks are used by programs with affiliates in regions where online payment platforms are unavailable. Some legacy affiliate programs still offer checks as a traditional payout option.

Pros

- Suitable for affiliates who lack access to digital payment methods.

- No platform-specific requirements, making it universally accessible.

Cons

- Long processing and delivery times.

- Risk of loss or theft during mailing.

- Affiliates may face bank processing fees when cashing checks.

Cryptocurrency

Payments are made using digital currencies such as Bitcoin or Ethereum. Cryptocurrency is ideal for affiliates in the tech or gaming industries, where cryptocurrency is more widely embraced.

For instance, some innovative affiliate programs, such as in blockchain startups, pay affiliates in cryptocurrency.

Pros

- Enables fast, borderless transactions with lower fees compared to bank transfers.

- Appeals to tech-savvy affiliates interested in decentralized finance.

- Transparent and traceable transactions via blockchain.

Cons

- High price volatility of cryptocurrencies.

- Affiliates must have a cryptocurrency wallet.

- Limited acceptance compared to traditional methods.

Prepaid debit cards

Payments are loaded onto a prepaid debit card, which affiliates can use like a standard bank card. This affiliate payment method is great for affiliates who prefer flexibility and immediate access to their earnings.

Rakuten Advertising offers prepaid debit card options through partners like Payoneer.

Pros

- Allows instant access to funds without a bank account.

- Useful for affiliates in countries with limited banking infrastructure.

- Prepaid cards can be reloaded for ongoing payouts.

Cons

- Setup and maintenance fees may apply.

- Limited to specific affiliate networks or card providers.

- Affiliates may incur ATM withdrawal fees.

Store credit

Store credit allows affiliates to earn rewards that can be redeemed within the merchant’s online store. It is effective for smaller affiliate programs or niche brands targeting loyal customers as affiliates. Store credit works best as referral marketing payment.

Small e-commerce brands often offer store credit as a flexible payout option for influencers or customers in their affiliate programs.

Pros

- Keeps earnings within the merchant’s ecosystem.

- Can encourage affiliates to promote your products more.

- No transfer fees or processing delays.

Cons

- Limits affiliates to spending their earnings only with the merchant.

- Less appealing for affiliates seeking cash payments.

These payment methods cater to different needs and scenarios, allowing merchants to customize their affiliate payment structure.

Pro tips to start affiliate payments

Implementing a smooth affiliate payment process is essential to building trust and maintaining strong relationships with your affiliates. Let’s look at some practical tips to set up and streamline your affiliate payment system effectively.

How to set up affiliate payouts?

Establishing a payout process requires careful planning and setup. Here’s how to get started:

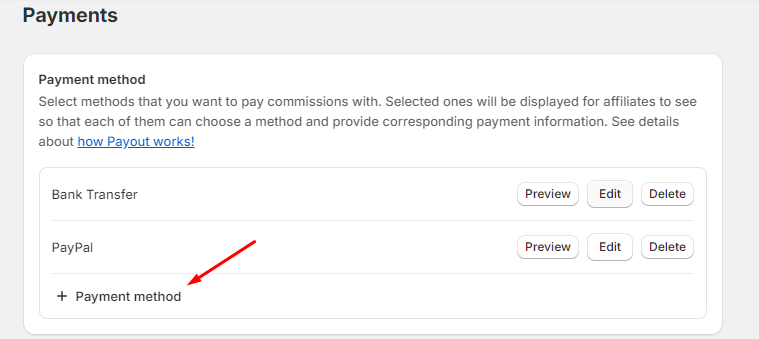

- Select payment methods: Choose methods that cater to your affiliates’ preferences, such as bank transfers, PayPal, or store credits.

- Set payout policies: Define and communicate:

- Payout thresholds: Minimum earnings required for payout.

- Payment frequency: Whether payouts occur monthly, bi-weekly, or upon request.

- Commission structures: Ensure clarity on how commissions are calculated.

- Onboarding Affiliates: Collect required payment details, such as email addresses for PayPal or banking information.

- Test payment system: Run small-scale tests to ensure accuracy before full implementation.

Automate the payment process

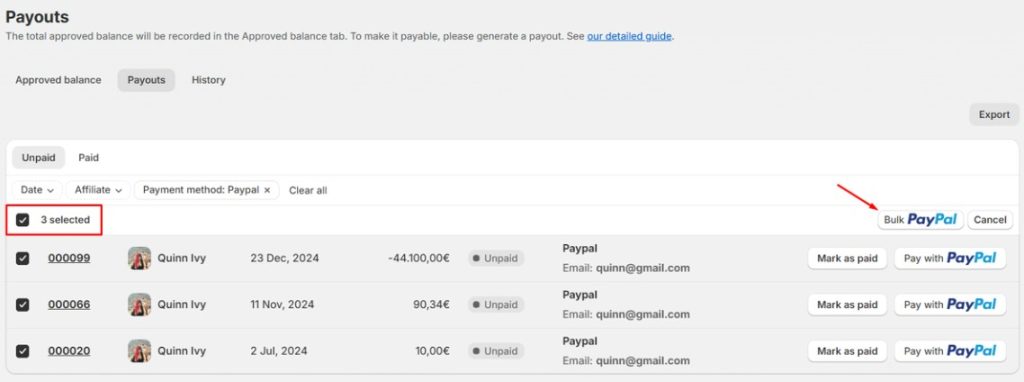

Manually tracking and disbursing affiliate payments can be time-consuming and error-prone. Instead, automate the process to save time and reduce mistakes. You can use BixGrow to pay affiliates all at once, rather than one by one.

Some key features of BixGrow for seamless affiliate payment:

- Automatic tracking of affiliate earnings.

- Bulk payout processing with just a few clicks.

- Customizable reports to monitor payment histories and performance.

On BixGrow, affiliates can be paid using the following options:

- Cash payments: Directly send payments via PayPal or bank transfers. Track commissions earned by affiliates on BixGrow to ensure accuracy. You can execute one-click payments through PayPal for convenience.

- Coupon codes: Offer store credits in the form of coupon codes as an alternative to cash payments. Affiliates can use these codes for personal purchases or share them with their audiences.

Set clear payment policies

Transparency is key. Clearly outline payment policies, including:

- Payout Thresholds: State the minimum amount required for a payout.

- Payment Cycles: Define when payments are processed (e.g., monthly, bi-weekly).

- Deductions: Highlight any potential fees (e.g., transfer charges or currency conversion fees)

Provide transparent reports

Affiliates appreciate transparency in tracking their earnings. Offer detailed reports that show:

- Total commissions earned.

- Pending payouts.

- Deductions (e.g., refunds or chargebacks).

BixGrow’s dashboard provides affiliates with real-time updates on their earnings, making the payment process transparent and reliable.

Ensure legal compliance

Payment methods and terms should comply with local regulations, including tax reporting. For example

- Issue tax forms like W-9 (US) or equivalent for international affiliates.

- Retain documentation of all transactions for auditing purposes.

Provide excellent support

Affiliates may have questions or face issues with payments. Offer dedicated support channels to assist them promptly.

By implementing these tips, you can establish a seamless affiliate payment system that builds trust and enhances your program’s success. With tools like BixGrow, managing and automating affiliate payments has never been easier, empowering both merchants and affiliates to focus on growth.

Conclusion

Choosing the right affiliate payment methods and implementing a seamless payout process is critical to the success of your affiliate program. From understanding the fundamentals of affiliate payments to exploring the pros and cons of popular methods like bank transfers, PayPal, cryptocurrency, and store credit, the goal is to offer flexibility, reliability, and transparency to your affiliates.

Using a tool like BixGrow can simplify this process, providing automation, multiple payment options, real-time earnings tracking, and compliance features.

In the competitive world of affiliate marketing, a well-structured payment system isn’t just a convenience – it’s a necessity. Equip yourself with the right tools and strategies to create a win-win environment where both your business and your affiliates can thrive.

.